Unleashing the Power of Compound Growth: Your Roadmap to Million-Dollar Retirement

Harnessing the Magnificent Power of Compound Growth

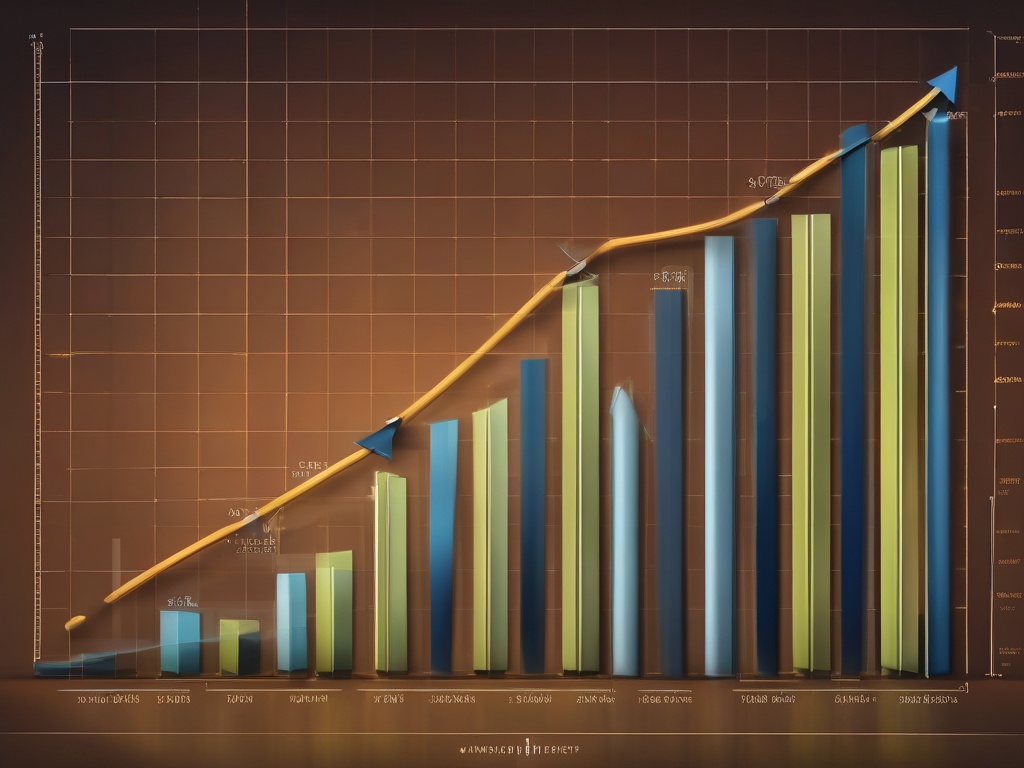

Imagine watching your wealth multiply exponentially over time, transforming an initial investment of $100,000 into a staggering $1,000,000 by retirement. This isn’t a fantasy reserved for the ultra-rich; it’s a real possibility for anyone willing to understand and harness the *extraordinary power of compound growth*. The secret lies in making your money work intelligently, allowing interest to generate more interest, creating a snowball effect that accelerates your journey toward financial independence.

Compound growth is often called the eighth wonder of the world because of its ability to generate exponential returns over the long term. By consistently investing and reinvesting your earnings, you essentially create a cycle where your wealth grows faster with each passing year. This strategy surpasses traditional savings methods, which simply rely on slow, linear accumulation. The key is to start early, stay disciplined, and choose investments that provide steady growth, setting the stage for your money to snowball into a millionaire’s nest egg.

Strategic Investment Approaches to Maximize Growth

Turning a modest $100,000 into a million requires more than just patience; it demands strategic foresight and disciplined execution. Diversification across various asset classes—stocks, bonds, real estate, and emerging markets—can optimize your growth potential while managing risk. High-growth stocks and index funds are often favored for their ability to deliver superior returns over time, especially when compounded over decades. Additionally, leveraging tax-advantaged accounts like IRAs and 401(k)s can significantly boost your wealth accumulation by minimizing taxes and maximizing your investment horizon.

Furthermore, adopting a disciplined contribution plan—whether through automatic monthly transfers or lump-sum investments—ensures consistent growth. Combining this with regular portfolio reviews and rebalancing helps align your investments with evolving market conditions and personal goals. Remember, the journey to a million-dollar retirement isn’t about shortcuts or risky gambles; it’s about smart, consistent investing, patience, and a steadfast commitment to your financial future.

Ultimately, the path to turning $100K into $1M by retirement is a testament to the *power of compounding and strategic investment*. By making informed decisions, staying disciplined, and harnessing the exponential growth potential of your investments, you can achieve your dream of a secure, comfortable, and prosperous retirement—without ever relying on luck or gambling.

Strategic Wealth Building: Mastering Investment Vehicles Beyond the Ordinary

While many focus solely on traditional stocks and bonds, the realm of investment vehicles offers a wealth of opportunities that can accelerate your journey toward a million-dollar retirement. To truly harness the power of compounding, it’s essential to explore alternative and often overlooked avenues that can provide higher returns, diversified risk, and tax advantages. These strategies demand a keen understanding and disciplined execution, but the payoff can be extraordinary when aligned with your long-term vision.

One of the most compelling options is real estate investment. Unlike stocks, real estate offers tangible assets that can appreciate over time, generate passive income through rentals, and provide opportunities for tax deductions. Whether it’s direct property ownership, real estate investment trusts (REITs), or crowdfunding platforms, real estate can serve as a powerful vehicle to diversify your portfolio and harness the benefits of leverage—amplifying your growth potential without the need for excessive capital upfront.

Another game-changing avenue is private equity and venture capital. While these investments are often more complex and require a higher level of due diligence, they can deliver impressive returns that far surpass traditional markets. Investing in startups, emerging industries, or private companies can be achieved through specialized funds or syndicates, providing an opportunity to participate in groundbreaking innovations and technological advancements. The key is to approach such investments with caution, thorough research, and a clear understanding of the risks involved.

Furthermore, alternative investments such as commodities, hedge funds, and structured products can add an extra layer of diversification and growth potential to your portfolio. Commodities like gold, oil, or agricultural products tend to perform differently than stocks and bonds, acting as a hedge against inflation. Hedge funds and structured products often employ sophisticated strategies to generate alpha—returns above the market—regardless of economic conditions. These vehicles require careful selection, but when integrated strategically, they can significantly enhance your wealth-building trajectory.

In the pursuit of your financial goal, it’s essential to view your investment landscape as a dynamic ecosystem rather than a static set of options. By understanding the unique advantages and risks associated with each vehicle, and aligning them with your risk tolerance and time horizon, you can craft a resilient, high-growth portfolio. This holistic approach ensures that your capital is working diligently across different sectors, providing multiple streams of potential growth—each contributing to the ultimate goal of turning $100K into a million-dollar nest egg before retirement.

Smart Financial Habits and Mindset Shifts to Accelerate Your Path to a Million

Developing a Growth-Oriented Financial Mindset

To truly harness the power of compounding and strategic investing, cultivating a mindset focused on growth and disciplined wealth accumulation is essential. This means shifting away from short-term gratification and embracing patience as a core principle. Recognize that building wealth is a marathon, not a sprint, and that every dollar invested today has the potential to multiply exponentially over time. Adopting a long-term perspective helps you resist impulsive decisions driven by market fluctuations or fleeting trends. Instead, focus on consistent contributions and staying committed to your financial plan, understanding that resilience and persistence are key to transforming your initial $100,000 into a million-dollar nest egg.

Embracing Financial Discipline and Strategic Spending

One of the most impactful shifts is cultivating disciplined financial habits that prioritize saving and investing over unnecessary expenditures. This involves creating a budget that aligns with your long-term goals, limiting lifestyle inflation, and avoiding impulse purchases that divert funds from your investment objectives. Automating contributions ensures that a portion of your income is consistently directed toward your investment accounts without requiring constant oversight. This kind of disciplined approach not only accelerates your wealth growth but also reinforces your commitment to financial independence. Mindful spending, coupled with strategic saving, creates a solid foundation that allows your investments to compound at a faster rate, pushing you closer to that coveted $1 million milestone.

Cultivating Resilience and Flexibility in Your Financial Journey

Building substantial wealth over decades requires more than just good habits; it demands resilience and adaptability amidst changing economic landscapes. Developing a mindset that views market downturns as opportunities rather than setbacks fosters a resilient attitude that keeps you focused on your long-term vision. It’s vital to stay informed and flexible, adjusting your investment strategies as needed to capitalize on emerging trends or mitigate risks. Staying educated and open to new opportunities can open doors to higher returns and help you navigate unforeseen challenges without veering off course. Ultimately, the journey to turning $100K into $1M by retirement is as much about cultivating the right attitude and habits as it is about selecting the best investment vehicles. Embrace these mindset shifts and habits, and you’ll find yourself steadily accelerating toward your financial aspirations, transforming dreams into tangible reality.