Unveiling the Hidden Power of Factor Investing: Transform Your Portfolio with Smart Beta Strategies

Unlocking the True Potential of Factor Investing

In the dynamic world of financial markets, factor investing has emerged as a revolutionary approach that challenges traditional passive and active management strategies. By focusing on specific characteristics or factors such as value, momentum, size, and quality, investors can systematically tilt their portfolios to harness excess returns. This method isn’t just a trend; it’s backed by decades of academic research and real-world performance data, revealing a hidden power capable of significantly enhancing investment outcomes.

What makes factor investing truly compelling is its ability to distill complex market behavior into measurable, repeatable strategies. Instead of relying on unpredictable market timing or gut feelings, smart beta strategies leverage data and analytics to identify, capture, and capitalize on persistent risk premiums. This approach democratizes sophisticated investment techniques, allowing individual investors and institutions alike to unlock the potential for superior returns while maintaining transparency and control over their portfolios.

Transformative Strategies for a Resilient Portfolio

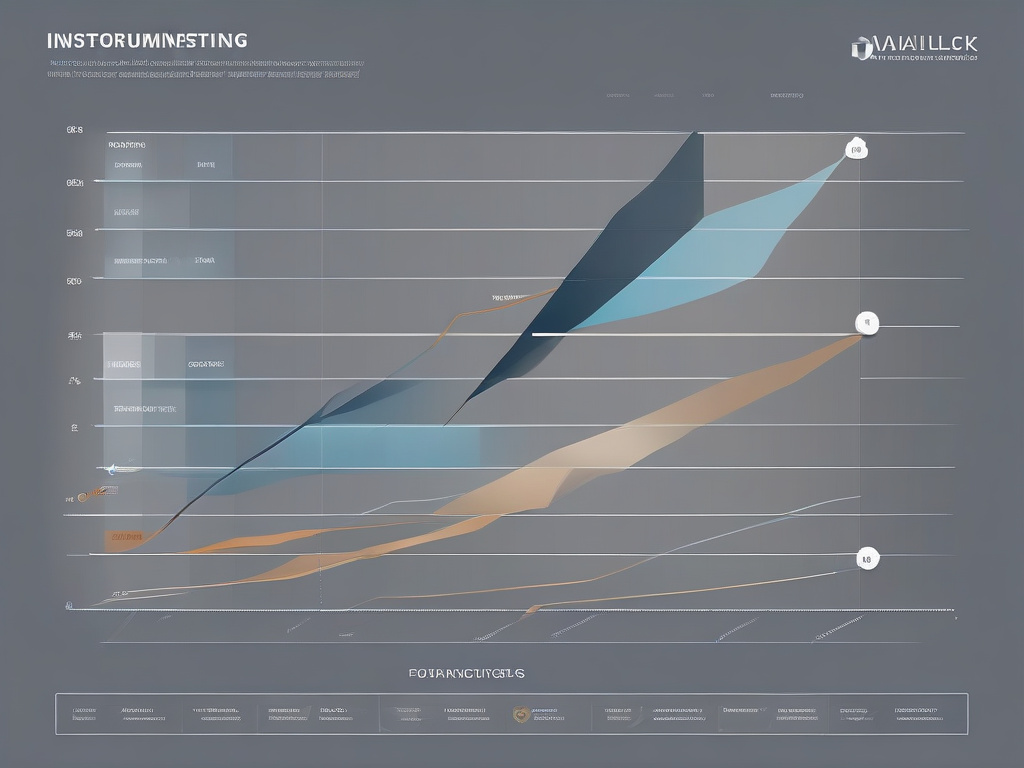

Implementing smart beta strategies rooted in factor investing can be a game-changer, especially in unpredictable markets. These strategies serve as a bridge between passive index investing and active management, offering a balanced approach that aims for enhanced returns without the high fees and risks associated with active funds. By systematically emphasizing factors that have historically outperformed, investors can build a more resilient and adaptive portfolio capable of weathering market storms and capitalizing on emerging opportunities.

When comparing traditional market-cap-weighted indices to factor-based smart beta ETFs, the differences become stark. While conventional indices often overweight overhyped stocks and underweight undervalued gems, factor strategies directly target the underlying drivers of return, such as undervaluation or strong momentum. This targeted approach not only improves potential upside but also offers a more robust risk management framework. As markets evolve, integrating these strategies into your investment plan can unveil a new dimension of portfolio efficiency, turning complex market signals into actionable investment advantages.

Decoding the Science Behind Smart Beta: Unlocking Alpha through Innovative Factor Models

Unveiling the Quantitative Foundations of Smart Beta

At the core of effective factor investing lies a sophisticated understanding of market dynamics, driven by rigorous quantitative analysis. Unlike traditional investing, which often relies heavily on intuition or historical averages, smart beta strategies are constructed upon a foundation of empirical data and statistical evidence. These models dissect market behavior into measurable components, enabling investors to identify persistent risk premiums associated with specific factors such as value, size, or momentum.

By leveraging advanced algorithms and data-driven insights, investors can isolate and optimize these factors, transforming complex financial signals into clear, actionable signals. This scientific approach ensures that strategies are not just based on historical trends but are continuously refined through ongoing analysis, allowing for dynamic adjustments that adapt to changing market conditions. The result is a robust framework that systematically enhances the probability of achieving superior risk-adjusted returns.

Harnessing Multi-Factor Models to Maximize Alpha

One of the most compelling developments in smart beta investing is the integration of multi-factor models, which combine several factors into a unified investment approach. This multidimensional perspective recognizes that markets are influenced by a constellation of factors working simultaneously, and isolating the interplay among them can reveal hidden sources of return that single-factor strategies might overlook. For example, blending value, momentum, and quality factors can not only diversify risk but also amplify potential gains by capturing multiple sources of alpha.

Innovative factor models utilize complex statistical techniques, such as machine learning and artificial intelligence, to uncover non-linear relationships and subtle patterns often missed by traditional methods. These models offer a more nuanced understanding of market behavior, empowering investors to formulate strategies that are both adaptive and resilient. When executed with precision, multi-factor approaches can unlock new levels of alpha, challenging conventional assumptions and setting a new standard for systematic investing.

Mastering Risk and Return: How Factor Investing Redefines the Future of Investment Management

Redefining Risk with Precision and Purpose

As the financial landscape evolves, so does the understanding of risk management. Traditional methods often rely on broad diversification and historical data, but smart beta strategies elevate this approach by explicitly targeting the sources of risk and return. By focusing on factors such as volatility, liquidity, and downturn resilience, investors can craft portfolios that are not only optimized for growth but are also resilient against unexpected shocks. This strategic focus transforms risk from an unpredictable element into a measurable and manageable component. The power of factor investing lies in its ability to systematically identify which factors are likely to outperform under different market regimes, allowing investors to dynamically adjust their exposures. Ultimately, this approach heralds a new era where risk is not just mitigated but strategically harnessed to generate superior risk-adjusted returns, redefining how investors perceive and manage uncertainty.

Enhancing Return Potential Through Multi-Dimensional Strategies

Traditional investment models often view risk and return as separate, sometimes conflicting, facets. However, in the realm of factor investing, this dichotomy is dissolving. By integrating multiple factors—such as size, value, momentum, and quality—investors can construct multi-dimensional portfolios that unlock a richer tapestry of return opportunities. This layered approach not only diversifies across different sources of alpha but also amplifies the potential for excess gains by capitalizing on the interplay among various market drivers. The use of advanced analytical tools, including machine learning, enables the identification of non-linear relationships between factors, revealing subtle signals that can be exploited for alpha generation. As a result, this holistic perspective elevates portfolio performance, balancing risk and reward in ways that traditional single-factor strategies often fail to achieve. It’s a paradigm shift—an evolution toward a more sophisticated, adaptable model of investment management that harnesses the full spectrum of market dynamics.

, “meta_keywords”: “factor investing, smart beta, risk management, multi-factor strategies, alpha, investment management, portfolio optimization, systematic investing, risk-adjusted returns