Unlocking Wealth: The Astonishing Power of the Rule of 72

Discover the Hidden Secret to Doubling Your Money Effortlessly

Imagine having a straightforward tool that can dramatically alter your financial future without the need for complex calculations or risky investments. The Rule of 72 is exactly that: a simple yet powerful mathematical shortcut that allows you to estimate how long it will take for your money to double at a given interest rate. With just a basic understanding, you can unlock the secrets of exponential growth and make smarter decisions to accelerate your wealth accumulation.

Understanding the Mechanics Behind the Rule of 72

At its core, the Rule of 72 states that you divide 72 by the annual rate of return to estimate the number of years needed for your investment to double. For example, if you earn a 9% return annually, it will take approximately 8 years (72 ÷ 9) for your investment to double. This simple calculation provides an impressive insight into the power of compound interest, demystifying what often seems like an elusive concept and empowering everyday investors to plan their financial futures with confidence.

Why the Rule of 72 Is a Game-Changer for Wealth Building

Unlike complex financial models or projections that can be overwhelming, the Rule of 72 offers an intuitive grasp of how different rates of return impact your wealth over time. It emphasizes the importance of seeking higher interest rates and understanding the compounding effect—factors that can significantly shorten the timeline to double your money. By applying this rule, investors can compare various investment options swiftly, identify the most promising opportunities, and set realistic goals. Ultimately, this knowledge transforms passive saving into active wealth-building, making the rule an indispensable tool for anyone eager to grow their finances efficiently and effectively.

Mastering the Math: How the Rule of 72 Accelerates Your Financial Growth

Understanding the mathematical foundation of the Rule of 72 reveals why it’s such a potent tool for savvy investors. At its core, this rule leverages the power of exponential growth, which often seems daunting until broken down into simple, manageable calculations. When you grasp how interest compounds over time, you realize that even modest annual returns can lead to significant wealth accumulation when viewed through the lens of this rule.

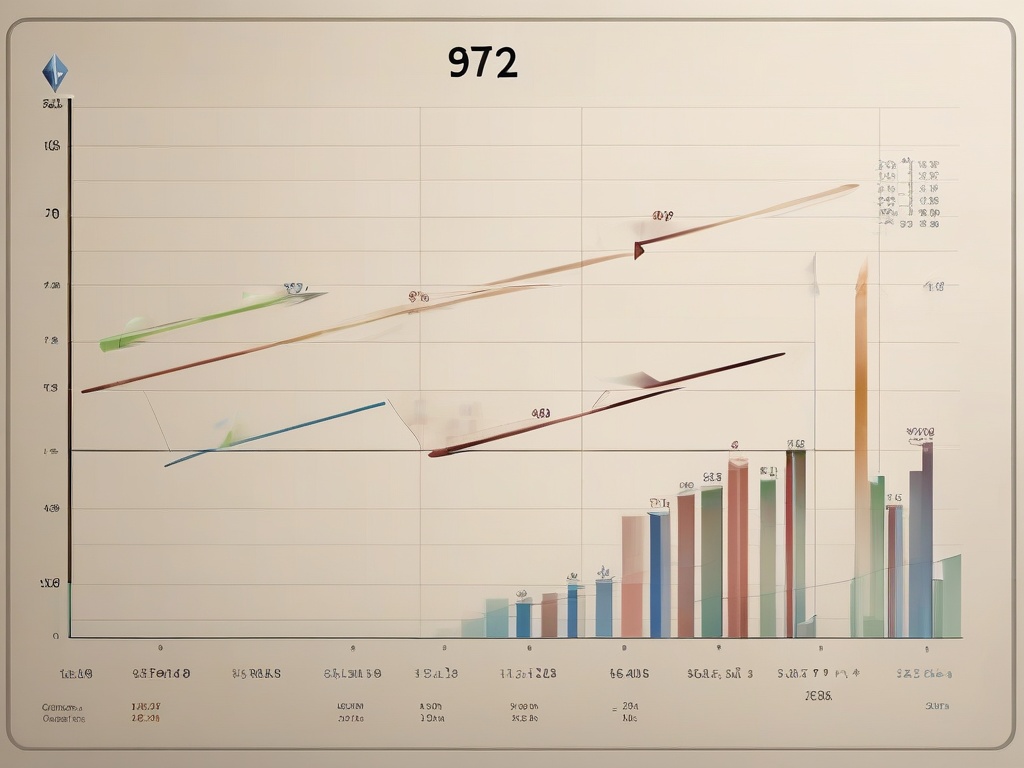

By dividing 72 by your expected rate of return, you gain an immediate snapshot of the years required for your investment to double. For instance, at a 6% annual return, it takes approximately 12 years; at 12%, only six years. This straightforward insight allows you to compare different investment vehicles effortlessly, enabling you to prioritize higher-yield options that can accelerate your journey to financial freedom. What’s truly impressive is how this simple equation encapsulates the essence of compound interest—highlighting the exponential growth potential that often goes unnoticed in traditional savings strategies.

Understanding the Impact of Rate of Return on Doubling Time

One of the most compelling aspects of mastering the Rule of 72 is recognizing how even small increases in interest rates drastically reduce the doubling period. For example, increasing your rate from 6% to 8% cuts the doubling time from 12 to 9 years—a reduction of 25%. When you realize that a mere 2% difference can significantly alter your timeline, it becomes clear why seeking higher yields and reinvesting earnings are essential for exponential wealth growth. This understanding empowers investors to prioritize financial products and strategies that maximize returns, turning patience and discipline into tangible results.

Strategies to Maximize Growth Using the Rule of 72

Applying the rule isn’t just about making quick calculations; it’s about integrating this knowledge into your overall financial strategy. By actively seeking investment opportunities with higher interest rates—whether through stocks, mutual funds, or real estate—you can substantially reduce the years needed to double your money. Additionally, understanding the importance of compounding frequency—monthly, quarterly, or annually—can further enhance growth. The more frequently your interest compounds, the faster your wealth multiplies, and the Rule of 72 becomes an even more powerful guide in your financial toolkit. Mastery of this simple yet profound principle transforms passive saving into active wealth-building, positioning you for a future where financial independence is not just a goal but a tangible reality.